Investing in Costa Rica commercial property is not just a dream but a viable opportunity for both local and foreign investors looking for a vibrant market ripe with potential.

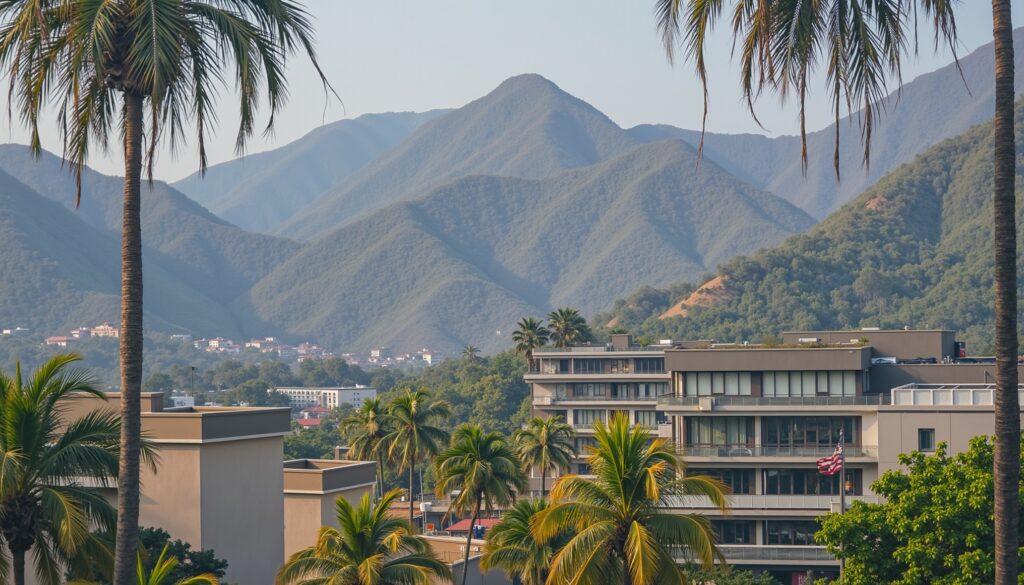

Nestled between the Pacific Ocean and the Caribbean Sea, Costa Rica boasts a stunning natural landscape, a stable political climate, and a growing economy, making it one of the most attractive destinations for commercial real estate investment in Central America.

In this guide, we will delve into the various aspects of the Costa Rican commercial property market, offering insights into its benefits, key considerations for investors, types of properties available, legal regulations, and future market trends.

Whether you’re an experienced real estate mogul or a curious newcomer, this comprehensive guide aims to equip you with the knowledge you need to successfully navigate the Costa Rican commercial property landscape.

Key Takeaways

- Costa Rica’s real estate market offers diverse investment opportunities for commercial properties.

- Investing in Costa Rica commercial property provides benefits such as stable returns and a growing economy.

- Foreign investors should consider factors like local regulations and market trends before investing.

- The types of commercial properties available in Costa Rica range from retail spaces to office buildings.

- Understanding the legal framework is crucial for a successful commercial property investment in Costa Rica.

Understanding the Costa Rican Real Estate Market

Understanding the Costa Rican real estate market is essential for anyone considering an investment in this tropical paradise.

As one of the most stable countries in Central America, Costa Rica attracts both retirees and investors looking for lucrative opportunities.

The Costa Rica commercial property market has seen significant growth, driven by the increasing demand for tourism and business infrastructure.

With its strategic location, diverse ecosystems, and a friendly investment climate, Costa Rica offers a variety of commercial real estate options, from retail spaces and office buildings to resorts and vacation rentals.

Additionally, the country’s commitment to sustainable development and eco-friendly practices enhances the appeal of commercial properties, making them attractive not only for investment but also for ethical ownership.

Understanding the nuances of this market, including zoning laws and property taxes, will empower potential buyers to make informed decisions and capitalize on the various opportunities that Costa Rica has to offer.

Benefits of Investing in Costa Rica Commercial Property

Investing in Costa Rica commercial property offers numerous advantages that attract both seasoned investors and newcomers alike.

One of the primary benefits is the nation’s stable political climate and progressive economic growth, which creates a conducive environment for business ventures.

Costa Rica is well-known for its welcoming approach to foreign investors, and its strategic location allows for easy access to North and South American markets.

Furthermore, the thriving tourism industry, bolstered by its stunning natural beauty and biodiversity, increases the demand for commercial properties, especially in hot spots like San José, Tamarindo, and Manuel Antonio.

Additionally, favorable governmental incentives and a growing expat community present unique opportunities for those looking to invest in retail, hospitality, or office spaces.

With a solid infrastructure and commitment to sustainable development, Costa Rica commercial property not only promises potential profitability but also aligns with eco-conscious values, making it a wise choice for investors.

‘Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.’ – Franklin D. Roosevelt

Key Considerations for Foreign Investors

When it comes to investing in Costa Rica commercial property, foreign investors must navigate several key considerations to ensure a successful venture.

Firstly, it’s crucial to understand the legal framework governing property ownership in Costa Rica.

Unlike some countries, foreign nationals can own real estate, including commercial properties, without restrictions.

However, it’s advisable to work with a reputable local attorney who can guide you through the purchasing process and help you understand the due diligence needed to avoid potential pitfalls.

Additionally, investors should conduct thorough market research to identify prime locations that align with their business objectives.

Popular areas such as San José and the coastal regions offer different advantages, from accessibility to tourist foot traffic.

Moreover, it’s essential to consider the potential return on investment (ROI) and the overall economic outlook of Costa Rica, as this can vary greatly based on market trends and local developments.

By taking these considerations into account, foreign investors can make informed decisions about their commercial real estate investments in Costa Rica.

Types of Commercial Properties Available in Costa Rica

Costa Rica commercial property encompasses a diverse range of options that cater to investors looking to capitalize on the country’s burgeoning economy and stunning landscapes.

Whether you’re eyeing beachfront resorts, bustling retail spaces, or productive agricultural land, the opportunities are abundant.

Retail properties can be found in vibrant city centers like San José, attracting both locals and tourists, whereas office spaces in growing business districts are perfect for startups and established firms alike.

Additionally, investing in industrial properties offers access to Costa Rica’s strong logistics network, ideal for manufacturing or distribution businesses.

For those inclined towards tourism, hospitality properties such as hotels or eco-lodges can be lucrative investments, especially in popular areas like Guanacaste or the Central Valley.

Overall, the variety of Costa Rica commercial property available presents an exciting prospect for investors aiming to leverage the country’s unique advantages.

Legal Framework and Regulations for Property Investment

When considering Costa Rica commercial property for investment, it is crucial to understand the legal framework and regulations that govern real estate transactions in the country.

The Costa Rican Constitution supports private property rights, making it a favorable market for both local and foreign investors.

The country has established a comprehensive legal system that ensures transparency and security in property transactions.

Foreigners can own property in Costa Rica with ease, including commercial real estate, without needing a local partner.

However, investors should be aware of specific regulations, such as zoning laws and environmental restrictions, which may impact property use and development.

Additionally, engaging a local attorney who specializes in real estate can help navigate the complexities of the Costa Rican legal system, ensuring compliance with all necessary regulations.

By understanding these components, potential investors can make informed decisions and capitalize on the growth opportunities that Costa Rica’s dynamic commercial property market offers.

Future Outlook: Trends in Costa Rica’s Commercial Real Estate

As we delve into the future outlook of Costa Rica’s commercial real estate landscape, it’s essential to understand the key trends shaping the market.

The Costa Rica commercial property sector is seeing a surge in demand, fueled by the country’s stable political climate and its growing reputation as a hub for international business and tourism.

Additionally, new developments in urban areas are becoming more prevalent, with mixed-use projects that combine residential, commercial, and recreational spaces gaining traction.

With advancements in technology and a rising emphasis on sustainability, investors are increasingly focused on eco-friendly projects that not only promise higher returns but also contribute positively to the environment.

As multinational corporations continue to establish their presence in Costa Rica, there is an undeniable shift towards high-demand properties located in strategic locations, especially in and around San José and other key urban centers.

This upward trend highlights the vitality of Costa Rica’s commercial property market, making it an exciting area for potential investors looking to capitalize on the evolving economic landscape.

Frequently Asked Questions

What are the main benefits of investing in commercial property in Costa Rica?

Investing in commercial property in Costa Rica offers several benefits, including a growing economy, favorable investment climate, potential for high returns, and a stable political environment.

Additionally, the country’s natural beauty and appeal as a tourist destination can increase demand for commercial spaces.

What types of commercial properties are available in Costa Rica?

Costa Rica offers various types of commercial properties, including retail spaces, office buildings, industrial properties, hospitality businesses, and mixed-use developments.

Each type caters to different market needs, depending on the location and economic activity.

What legal considerations should foreign investors be aware of?

Foreign investors should familiarize themselves with Costa Rica’s legal framework, including property rights, land ownership regulations, taxes, and zoning laws.

It’s also advisable to engage a local attorney who specializes in real estate to navigate the process smoothly.

How is the real estate market performing in Costa Rica?

The Costa Rican real estate market has shown resilience and growth, driven by factors such as tourism, an expanding expatriate community, and economic stability.

Current trends indicate an increasing demand for commercial properties, particularly in prime locations.

Are there any specific risks associated with investing in Costa Rica commercial property?

Like any investment, there are risks involved, including market fluctuations, changes in government policies, and environmental factors.

Conducting thorough market research and due diligence can help mitigate these risks and make informed investment decisions.