If you’re considering diving into the world of real estate, the Pacific Coast offers a wealth of opportunities for savvy investors.

With its stunning natural beauty, vibrant culture, and growing economy, investment properties along the Pacific Coast have become highly sought after.

Whether you’re looking for a vacation rental, a long-term investment, or a place to retire, understanding the local market dynamics and leveraging the right strategies can set you on the path to financial success.

In this guide, we’ll explore the benefits of investing in Pacific Coast real estate, analyze market trends for potential returns, and discuss crucial factors to consider when selecting investment properties.

Key Takeaways

- Investing in Pacific Coast real estate offers unique opportunities due to its desirable location and climate.

- The Pacific Coast market shows promising trends with potential for high returns on investment properties.

- Careful analysis of market conditions and local demand is crucial when selecting properties.

- Consider factors like financing options and property management before investing in the Pacific Coast market.

- Informed decisions are essential for maximizing the long-term benefits of investment properties in this region.

Introduction to Investment Properties on the Pacific Coast

Costa Rica has emerged as a premier destination for those looking to invest in real estate, particularly on the lush and stunning Pacific Coast.

With its breathtaking beaches, vibrant culture, and diverse ecosystems, the Pacific Coast offers a variety of investment properties that can cater to different preferences and budgets.

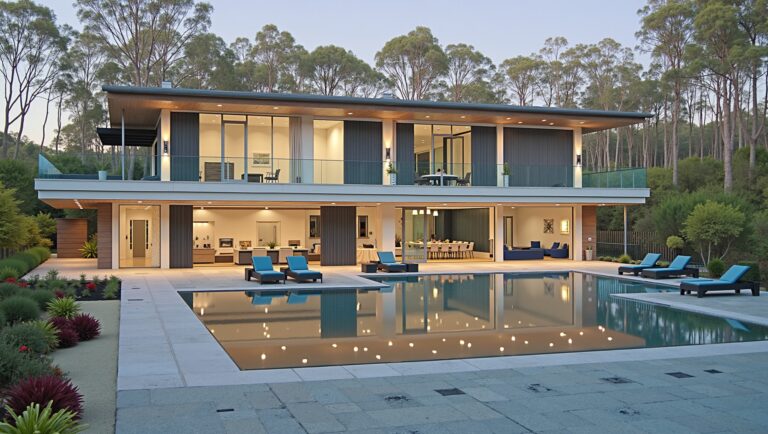

Investors can find everything from luxurious beachfront villas to charming condos in thriving towns, making it an attractive option for both personal use and rental potentials.

The demand for vacation rentals in this region continues to surge, driven by a steady influx of tourists seeking unforgettable experiences and natural beauty.

As the real estate market on the Pacific Coast evolves, savvy investors are taking note of the growing opportunities, from residential properties to commercial ventures, positioning themselves to benefit from the area’s promising economic growth and stable property values.

The Benefits of Investing in Pacific Coast Real Estate

When considering investment properties, the Pacific Coast of Costa Rica stands out as a prime destination for real estate enthusiasts.

The allure of this stunning region lies in its breathtaking landscapes, vibrant culture, and a growing economy, making it an attractive option for both domestic and international investors.

One of the key benefits of investing in Pacific Coast real estate is the potential for rental income, driven by the influx of tourists year-round seeking sun, surf, and adventure.

Additionally, Costa Rica’s stable political climate and favorable foreign ownership laws provide a secure environment for investment.

The Pacific Coast is well-known for its pristine beaches, lush jungles, and laid-back lifestyle, factors that not only drive tourism but also increase property values over time.

Moreover, with a diverse range of properties available, from luxurious beachfront villas to more affordable condos, there are options that cater to various budgets and investment strategies.

In summary, investing in Pacific Coast real estate can yield significant long-term benefits, making it a wise choice for savvy investors.

‘The best time to plant a tree was twenty years ago. The second best time is now.’ – Chinese Proverb

Potential Returns: Analyzing Market Trends

When considering investment properties on the Pacific coast of Costa Rica, understanding current market trends is essential for maximizing potential returns.

The Pacific coast has seen a surge in demand due to its stunning landscapes, tropical climate, and accessibility to amenities, making it an attractive destination for both retirees and vacationers.

Recent statistics indicate that property values along Costa Rica’s Pacific coast have appreciated annually, driven by increasing tourism and expatriate interest.

Areas such as Guanacaste and Puntarenas are particularly popular, showcasing a robust rental market owing to their proximity to pristine beaches and vibrant cultural experiences.

Investors should closely monitor these trends, as well as the development of infrastructure and amenities, as they contribute significantly to property appreciation and rental yields.

With careful analysis and strategic planning, investing in properties along the Pacific coast can yield substantial long-term gains.

Factors to Consider When Choosing Investment Properties

When delving into the realm of investment properties, particularly on the stunning Pacific Coast of Costa Rica, several essential factors demand your attention.

First and foremost, the location is paramount; areas with easy access to beaches, amenities, and tourist attractions typically yield better rental returns because of their appeal to vacationers and expats.

Additionally, understanding the local real estate market trends is crucial—research recent sales data and property appreciation rates in the region to make an informed decision.

Moreover, consider the type of property—whether it be beachfront villas, condos, or commercial spaces—as each comes with its investment potential and risks.

Also, factor in the property management aspect; if you aren’t planning to live in Costa Rica full-time, securing a reliable property management service can help maintain and increase your investment’s value.

Lastly, navigating the legal landscape is vital; it’s advisable to consult with local real estate experts or legal advisors to understand property ownership laws and ensure a smooth transaction when acquiring investment properties on Costa Rica’s Pacific coast.

Financing Your Pacific Coast Investment

Investing in real estate can be an exciting venture, especially when considering the stunning properties available along Costa Rica’s Pacific Coast.

As home to some of the most picturesque beaches and vibrant communities, this area offers a wealth of opportunities for those interested in investment properties.

A pivotal step in ensuring your investment’s success is understanding the financing options available.

Many foreign investors may find it beneficial to explore local banks or investment funds that specialize in financing real estate transactions in Costa Rica.

Additionally, engaging with a knowledgeable local real estate agent can significantly ease the process, as they can guide you through various financing structures tailored for investment properties on the Pacific Coast.

Understanding these financial options not only helps in making informed decisions but also maximizes your potential returns, making your real estate venture a rewarding experience.

Conclusion: Making Informed Investment Decisions on the Pacific Coast

In conclusion, making informed investment decisions in the realm of investment properties on the Pacific coast requires a thorough understanding of local market trends, economic conditions, and the unique characteristics of the area.

With stunning beaches, a vibrant culture, and a growing tourism industry, the Pacific coast of Costa Rica presents an attractive opportunity for real estate investors.

However, it is essential to conduct comprehensive research and possibly consult with local real estate experts to navigate the nuances of this market successfully.

Whether you are considering a vacation rental, a permanent residence, or a long-term investment property, taking the time to educate yourself will empower you to make choices that align with your financial goals and lifestyle aspirations.

Frequently Asked Questions

What are investment properties on the Pacific Coast?

Investment properties on the Pacific Coast are real estate assets purchased with the intention of generating income, either through rental revenue, resale, or both.

These can include residential homes, vacation rentals, apartment complexes, or commercial properties.

What are the benefits of investing in Pacific Coast real estate?

The benefits include high demand for rental properties due to tourism and local amenities, potential for property appreciation in popular coastal areas, and the opportunity for diversification in your investment portfolio.

How can I assess the potential returns on Pacific Coast investment properties?

You can analyze market trends by researching historical property values, rental rates, economic indicators, and demographic data for the area.

This will help you to estimate cash flow, appreciation potential, and overall return on investment.

What factors should I consider when choosing an investment property on the Pacific Coast?

Key factors include location desirability, property condition, market trends, local economic conditions, zoning regulations, and potential for rental income in that area.

What financing options are available for investing in Pacific Coast properties?

Financing options include traditional mortgages, private loans, real estate investment groups, or partnerships.

It’s advisable to explore different financing routes and consider factors like interest rates, loan terms, and investor qualifications.