Investing in rental properties can be a lucrative venture, but it’s not without its risks.

One of the most effective ways to protect your investment is through rental property insurance.

In this essential guide, we will explore what rental property insurance is, why it is essential for landlords, the different types of coverage available, factors that affect your premiums, and crucial tips for selecting the right policy for your needs.

Additionally, we’ll debunk some common misconceptions surrounding rental property insurance, ensuring you have a well-rounded understanding of the subject.

Whether you’re a seasoned investor or a first-time landlord, this guide is designed to equip you with the knowledge needed to safeguard your rental properties effectively.

Key Takeaways

- Rental property insurance is crucial for protecting your investment from potential financial losses.

- Understanding the different types of coverage can help you tailor your insurance policy to your specific needs.

- Several factors, such as property location and property type, can influence your insurance premiums.

- When choosing rental property insurance, consider the coverage limits, deductibles, and additional endorsements available.

- There are several misconceptions about rental property insurance that can lead to inadequate coverage; it’s important to educate yourself.

What is Rental Property Insurance?

Rental property insurance is a specialized form of coverage designed to protect property owners from financial losses associated with their rental properties.

This insurance typically covers a wide range of risks, including property damage, liability claims, and rental income loss due to unforeseen events.

For instance, if a tenant causes accidental damage to the property or if natural disasters result in temporary uninhabitability, rental property insurance can help cover repair costs or replace lost income.

Additionally, it often includes liability protection if a tenant or visitor is injured on the premises, safeguarding landlords from potential lawsuits.

Understanding rental property insurance is crucial for landlords, as it not only provides peace of mind but also ensures that their investment remains financially secure.

Why You Need Rental Property Insurance

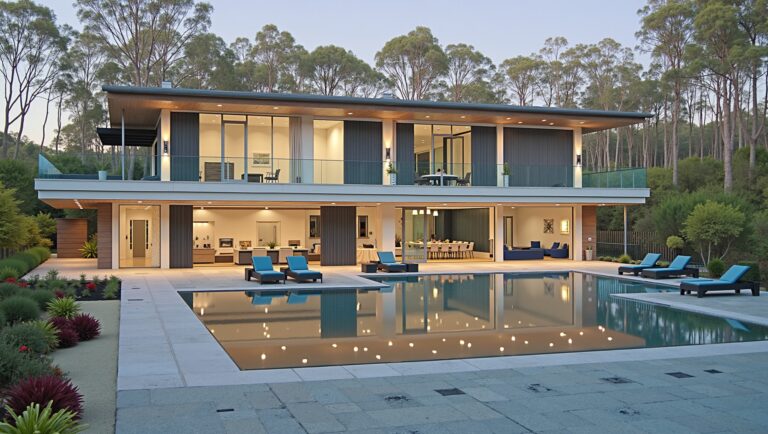

When venturing into the realm of real estate, particularly in bustling markets such as Costa Rica, understanding the importance of rental property insurance cannot be overstated.

Rental property insurance serves as a critical safeguard against potential financial losses that landlords may face due to damage or liability claims.

This type of insurance offers coverage for various scenarios, including natural disasters, theft, and tenant accidents.

Given Costa Rica’s unique climate and vibrant tourism scene, having this insurance can help mitigate the risks associated with operating a rental property.

Moreover, it provides peace of mind, ensuring that landlords can focus on providing a great experience for their tenants without the looming worry of unforeseen expenses.

As such, for those considering entering the Costa Rican rental market, securing reliable rental property insurance is not just advisable—it’s essential.

‘An ounce of prevention is worth a pound of cure.’ – Benjamin Franklin

Types of Coverage in Rental Property Insurance

When it comes to safeguarding your investment, understanding the types of coverage included in rental property insurance is essential.

Generally, rental property insurance falls into several categories, each designed to protect different aspects of your property and your financial interests.

The first type is property coverage, which protects the physical structure of the rental, including damage from disasters like fire, wind, or vandalism.

Next is liability coverage, vital for landlords, as it shields you against legal claims resulting from injuries or accidents that occur on your property.

Additionally, loss of income coverage is another crucial component, which compensates you for lost rental income if your property becomes uninhabitable due to a covered loss.

Lastly, it’s wise to consider optional coverages such as contents coverage for personal items in the rental and additional living expenses should your tenants need relocation temporarily.

Understanding these types of coverage in rental property insurance will help you make informed decisions to protect your investment effectively.

Factors Affecting Rental Property Insurance Premiums

When investing in rental property insurance, several key factors can significantly impact the premiums you will pay.

Firstly, the location of the rental property is paramount; properties situated in high-crime areas or regions prone to natural disasters will typically incur higher premiums due to increased risk.

Additionally, the type of property plays a crucial role.

For instance, single-family homes often have different rates compared to multi-family units or condo complexes.

The age and condition of the property are also considered; older structures may face higher rates due to the risk of maintenance issues or outdated systems.

Another important factor is the coverage amount; higher coverage limits to protect your property and potential rental income can lead to increased premiums.

Finally, your claims history is taken into account, as a history of frequent claims can signal higher risk to insurers and thereby raise your rates.

Understanding these factors can help landlords make informed decisions when selecting the most appropriate rental property insurance to protect their investment.

Tips for Choosing the Right Rental Property Insurance

When it comes to securing your investment in a rental property, choosing the right rental property insurance is essential.

Start by assessing your specific needs based on the type of rental property you own—be it a single-family home, condo, or multi-family unit.

Next, compare coverage options from different insurance providers to ensure you’re getting the best deal.

Look for policies that cover property damage, liability, and loss of rental income, as these are critical to safeguarding your investment.

Don’t overlook the importance of understanding the policy exclusions and deductibles; knowing what is not covered can save you from unexpected expenses down the line.

Finally, consider working with an insurance agent who specializes in rental property insurance to help you navigate through your options and select a policy tailored to your unique situation.

By taking the time to evaluate these factors, you can make an informed decision that protects both you and your rental property investment.

Common Misconceptions About Rental Property Insurance

When it comes to investing in real estate, particularly for rental properties, many potential landlords hold misconceptions about rental property insurance that can lead to costly mistakes.

One common myth is that standard homeowner’s insurance covers rental properties; however, this is typically not the case.

Rental property insurance is specifically designed to protect landlords from financial loss due to issues such as tenant damage, liability claims, and lost rental income.

Additionally, some believe that all insurance policies are the same, but coverage and pricing can vary significantly based on location, type of property, and even the insurer.

It’s also a frequent misconception that rental property insurance is optional; in reality, many mortgage lenders require it as part of the loan agreement.

Understanding these elements can help prospective landlords make informed decisions about protecting their investments and ensure they are adequately covered against unexpected events.

Frequently Asked Questions

What is rental property insurance?

Rental property insurance is a specialized policy designed to protect property owners from potential risks associated with renting out their properties.

It covers damages to the property itself and may also protect against liability claims, loss of rental income, and other related expenses.

Why do I need rental property insurance?

Rental property insurance is essential for safeguarding your investment.

It protects you from financial losses due to damages, natural disasters, tenant-related risks, or lawsuits.

Without this insurance, you could face significant out-of-pocket costs in the event of an unforeseen incident.

What types of coverage are included in rental property insurance?

Rental property insurance typically includes dwelling coverage, personal property coverage for furnishings, liability coverage for injuries occurring on the property, and loss of rental income coverage if the property becomes uninhabitable due to a covered event.

What factors can affect the premiums of rental property insurance?

Insurance premiums for rental property can be influenced by various factors such as the property’s location, the type of construction, the age and condition of the property, the amount of coverage required, and the owner’s claims history.

What are common misconceptions about rental property insurance?

Some common misconceptions include the belief that standard homeowners insurance suffices for rental properties, that all types of tenant damages are covered, and that insurance is not necessary for long-term rentals.

In reality, specialized rental property insurance is crucial to adequately protect your investment.